Higher Taxes Equate to Better Quality Movie Productions

February 08, 2023

Abi Peralta and Daniel Keniston

Do high taxes cause superstars to work less? In a recent working paper titled “Taxes and the Labor Supply of the Stars” released by the National Bureau of Economic Research, LSU Department of Economics Associate Professor Dan Keniston and Assistant Professor Abigail Peralta study this question among a unique group of wealthy individuals: Hollywood movie stars.

Examining superstars presents an ideal opportunity to study the effects of taxes on high incomes because they consistently earn some of the highest salaries in the country. Unlike CEOs or athletes, movie stars can flexibly choose how much they want to work each year. Because of actors’ long careers and the copious data available on the movie industry, the authors were able to collect information about the number and characteristics of films made by every U.S. actor from 1927-2014, both in high and low tax historical periods.

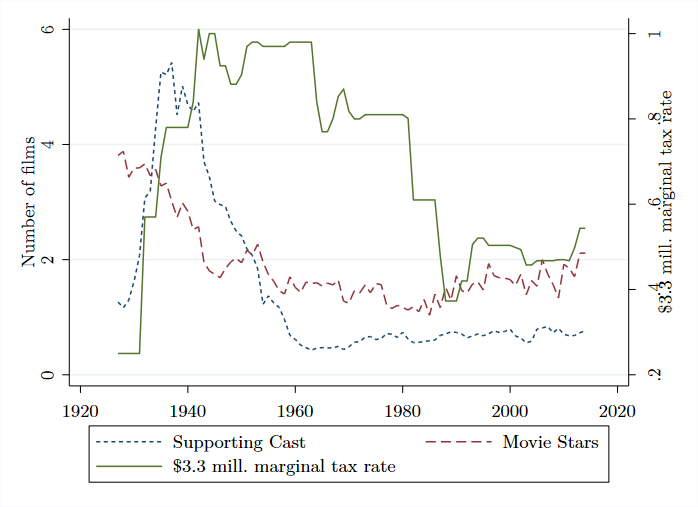

After analyzing the data, the authors encountered surprising results. They concluded that taxes have no effect on the annual number of films made by a performer, contrary to the claims of many observers. However, in years when taxes are high, movie stars choose to work on films that are of higher quality, reflected in their better ratings by critics and greater likelihood of being led by an Academy Award-winning director.

These findings suggest that performers value money as well as the prestige that comes from making quality films. Still, when high taxes diminish the financial returns of making “blockbuster” movies, stars tend to re-orient their performances towards more prestigious films with lower paychecks.

"Marginal taxes have changed dramatically over the past nine decades, as shown by the green line in the figure above. However, movie stars’ film production, in the dashed red line, is unrelated to the current tax rate. No episode demonstrates this better than the “Kennedy” tax cuts in 1963-5, which decreased stars’ tax rates by 21% yet caused no change in their rate of film production," said Keniston.

The Hollywood film industry has unique features that raise the question of the degree to which the results might generalize to other high-income workers. While every sector has distinctive institutions, the researchers view the friction to adjustment present in the film industry to be similar to those in other jobs. These results highlight the importance of extending the analysis of labor supply beyond quantity measures to include both human capital and non-pecuniary rewards of labor. Just as movie stars seem to take advantage of high tax periods to develop a reputation as “quality” actors when the opportunity cost of doing so is low, young workers may respond less to changes in wages due to incentives to accumulate human capital.

About the National Bureau of Economic Research

The National Bureau of Economic Research is an American private nonprofit research organization "committed to undertaking and disseminating unbiased economic research among public policymakers, business professionals, and the academic community.

About the Department of Economics

The Department of Economics at LSU’s E. J. Ourso College of Business offers courses that provide undergraduate and graduate students with strong analytic training and the tools to understand the economic and social problems faced both domestically and internationally. The numerous awards received and peer-reviewed scholarly articles published in high-quality economic journals demonstrate the faculty’s commitment to quality teaching and research.

For more information, visit the Department of Economics or call 225-578-5211.